Bitcoin Trading Strategies

Given Bitcoin's volatile and unpredictable nature, it's crucial to have a well-defined trading strategy before entering the market.

Bitcoin Trading Strategies for Spot

The Buy and Hold strategy remains a cornerstone for investors aiming to capitalize on Bitcoin's long-term growth potential. By purchasing Bitcoin at lower levels and holding it for the long term, investors can leverage the overall upward trajectory of a bull market to realize gains.

During Retracements in a Bull Market: Temporary pullbacks or retracements in an otherwise bullish market can provide favorable entry points, as these periods are often followed by a return to the prevailing upward trend.

To mitigate the impact of volatility, consider investing a fixed amount of money at regular intervals, regardless of the bitcoin's price. For example, building up your Bitcoin holdings on a monthly basis allows your assets to appreciate over time. Recurring buys automate this process, averaging out the purchase price and reducing the risk of market timing errors.

In a Bearish Market: Buying in a bearish market can be a strategic move, as prices are generally lower, allowing you to purchase bitcoin at a discount.

Bitcoin Trading Strategies for Futures

Bitcoin futures trading typically refers to Bitcoin perpetual contract trading

Perpetual Contracts

Perpetual contracts are derivative contracts similar to traditional futures, but with no expiry or settlement date, allowing traders to hold leveraged positions indefinitely. Thanks to their 'funding rates' mechanism, perpetual contracts tend to trade closer to the index price of the underlying asset compared to traditional futures.

The index price represents the average spot price of the underlying asset across multiple exchanges. A funding rate consists of two main components: the interest rate and the premium. The interest rate is typically constant and is based on the borrowing costs for the assets specified in the contract. The premium reflects the difference between the perpetual contract price and the mark price, which is derived from the index price.

When the funding rate is positive, long positions pay shorts. Conversely, when it is negative, short positions pay longs. The total funding amount is calculated as follows:

Funding = Position Value × Funding Rate

Funding rates incentivize traders to buy perpetual contracts when the contract price is below the index price and to sell when it is above. This mechanism helps keep the contract price closely aligned with the underlying asset's price.

Bitcoin Trading Strategy 1 for Futures: Risk Management

Even though bitcoin is known to be highly risky, you can control the outcome of your investment. The foremost thing is identifying the potential loss to set a countermeasure against the bear market.

When bitcoin futures traders successfully identify risks, how do they curb the potential loss?

Setting Stop-loss Orders

Bitcoin futures traders who use the stop-loss order set a price level at which they exist a contract position, mainly when the market movement is unfavorable.

Implementing the technical analysis strategy to set a stop-loss order to identify moving averages is always best. However, we recommend that you don't move too far away or close to your market entry price. Expert traders recommend a stop-loss price level of not less than 1% and not more than 10% of the entry price.

Position Sizing

Position sizing describes the level of risk you are willing to expose your capital to. To determine your position size, estimate your risk percentage, usually between 1% and 3%. Also, position sizing varies with traders due to tolerance and expertise level differences.

Here is a formula crypto futures traders use in calculating position size:

Position size = Maximum Risk / Stop-Loss Distance

Bitcoin Trading Strategy 2 for Futures: Technical Analysis

Technical analysis is a strategy used by Bitcoin futures traders to estimate the potential market conditions for Bitcoin.

In technical analysis, you examine market trends, volatility, historical prices, and chart patterns. The primary goal of this approach is to identify optimal times to buy and sell Bitcoin. Typically, informed Bitcoin futures traders buy when the market price is low and sell when it is high.

Below are three tools popularly used in technical analysis strategy.

Bitcoin Candlestick Chart

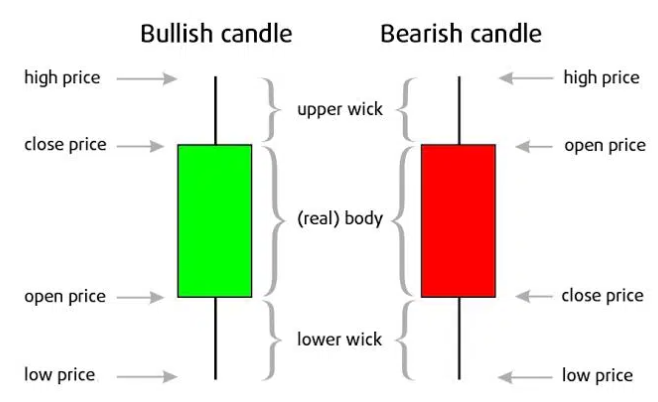

A candlestick chart helps identify Bitcoin's behavioral patterns within a specific time frame. For example, you can analyze the opening and closing prices, as well as the highest and lowest points of Bitcoin over the past week. The time frame can vary, ranging from as short as 10 minutes to as long as 24 hours.

If you see a red candlestick on the chart, it indicates that the asset ended the period at a lower price, signaling a bearish or negative trend. Conversely, a green candlestick represents a bullish or positive price movement. Additionally, thin lines called wicks appear above and below the candlesticks, providing extra information about market activity, such as the range of prices and the behavior of buyers and sellers.

Bitcoin Moving Averages

Moving averages are used to identify market trends and average price points for bitcoin over a specified time frame. The choice of time frame depends on the trading strategy employed. Short-term moving averages are more responsive to recent price changes, while long-term moving averages provide smoother trends by reducing daily fluctuations. Typically, short-term moving averages cover periods between 20 and 50 days.

Bitcoin Relative Strength Index

Measures the speed and change of bitcoin price movements. Values range from 0 to 100. Typically, RSI above 70 indicates overbought conditions, while RSI below 30 indicates oversold conditions.

Bitcoin Trading Strategy 3 for Futures: Trading Psychology

Four key emotions closely linked to trading psychology are fear, greed, hope, and regret. These emotions significantly impact the decision-making patterns of Bitcoin futures traders. For example, when traders are driven by greed, their judgment can become clouded, leading to an excessive desire for profit. Conversely, fear may push traders to make hasty decisions or take risks in hopes of generating substantial profits.

One of the best ways to manage trading psychology is to maintain discipline in your trading actions. If you've developed a trading strategy, stick to it and avoid deviations. However, if circumstances arise that require a change of plan, ensure that any adjustments are made with the intention of improving your outcomes.

Bitcoin Trading Strategies Conclusion for Futures

Since leverage plays a crucial role in Bitcoin futures trading, implementing strict trading strategies is essential. Leverage can lead to significant gains or losses, depending on a trader's skill and experience. By diligently applying the strategies discussed above, you can better navigate the highly volatile market and overcome its challenges.